Beyond the Stocktake: Inventory Insight from EOFY Data

Contents

🔍 You’ve done the count. Now what?

The stocktake is done. Discrepancies reviewed, reports submitted, and year-end numbers passed up the chain.

But before you close the books, pause.

EOFY isn’t just a compliance event. It’s one of the only times in the year when every data stream aligns: financials, fulfilment, inventory, and procurement. You’ve just created a consolidated snapshot of your entire operation.

This isn’t just a tick-box exercise. It’s an opportunity to step back and see the bigger picture — what’s working, what’s breaking, and where you’re silently losing time, cash, or margin.

Think of it as a macro view of your live dashboards, can’t give you. A retrospective that reveals long-term trends and inventory insights, not just short-term events.

What your EOFY data is already telling you (but you might be ignoring)

Here’s what top-performing businesses are now mining from their EOFY stocktake, and what it’s quietly telling supply chain leaders behind the scenes.

Reorder points that don’t reflect real-world conditions

EOFY is the perfect time to reassess whether your reorder points are aligned with reality. Frequent stockouts? Your reorder trigger is likely too conservative or based on inaccurate lead time assumptions. Overstocking? That points to outdated demand models or supplier inconsistency.

Why it matters: These aren’t minor misalignments. Every day a product is out of stock, you’re losing sales or production time. Every excess unit on the shelf is tying up cash and warehouse space.

EOFY Action Tip:

Review trailing 12-month consumption rates and cross-check them against actual lead time variability. Use this data to reset min/max levels, particularly for high-turn SKUs and known slow movers. Don’t rely on theoretical demand. Use your own historical truth.

Dead stock is quietly eroding your margins

Every warehouse has a dark corner. EOFY helps bring it to light.

Dead stock, items that haven’t moved in 6, 12, or even 18 months, quietly eats away at your bottom line. It ties up working capital, occupies shelf space, and masks inefficient procurement or product lifecycle decisions.

This isn’t just inventory bloat — it’s a sign of misalignment. Between sales and procurement. Between demand and supply. Between what you think is selling and what’s actually happening on the floor.

EOFY Action Tip:

Run a zero-movement report for the past 6–12 months. Categorise these SKUs: which can be bundled, discounted, written off, or returned to suppliers? Then review what led to the overstock. Is it poor forecasting? Poor demand signals? Or just poor visibility?

Fulfilment bottlenecks are hiding in plain sight

If your EOFY metrics show late dispatches, split shipments, or incomplete orders, don’t just chalk it up to “a busy season”.

Patterns in fulfilment issues often point to structural problems like inefficient pick paths, poor slotting strategies, under-trained staff, or over-complex SKUs.

The difference now? You have a full year’s worth of data to spot trends, not just yesterday’s performance.

EOFY Action Tip:

Analyse order-to-dispatch times across the past year. Break it down by SKU, location, and fulfilment team. Are delays tied to certain product categories or pick zones? Did average pick times increase in Q4? Use this data to re-map your warehouse, reskill staff, or simplify order profiles.

Margin drainers disguised as best sellers

EOFY helps expose one of the biggest hidden issues in warehouse operations: high-volume SKUs that secretly kill your margins.

These products often look great on sales reports. They move fast, turn regularly, and have consistent demand. But behind the scenes, they require manual repacking, custom labelling, multi-zone picking, or complex handling instructions that quietly inflate fulfilment costs.

And these margin vampires rarely show up in standard dashboards.

EOFY Action Tip:

Conduct a total cost-to-serve analysis per SKU. Go beyond purchase/sale price. Include labour hours, packaging, special handling, and freight. Highlight SKUs where margin erosion is happening. Either fix the process or rethink the product mix.

EOFY as a reset and a roadmap for strategic advantage

The most effective supply chain leaders treat EOFY as more than a reporting deadline. They see it as a strategic checkpoint and a chance to reflect, reset, and redirect for the year ahead.

Here’s how top-performing businesses use EOFY insights to gain a competitive edge:

1. Demand-driven forecasting, not just reordering

Static min-max settings and rule-of-thumb ordering won’t cut it anymore.

EOFY offers the dataset needed to build demand models rooted in actual customer behaviour, fusing seasonality, supplier trends, and SKU-level performance.

Best Practice:

Build rolling forecasts based on 12-month sales history, factoring in promotions, market shifts, and supply-side disruptions. Replace instinct with evidence and get procurement, sales, and ops aligned on one version of demand truth.

2. Inventory rationalisation to reduce complexity and cost

EOFY is the perfect trigger for SKU rationalisation.

Too many products = longer pick times, higher error rates, and more holding cost. Even worse, some SKUs exist because of legacy decisions no one’s reviewed.

Best Practice:

Use ABC analysis (by movement, margin, or volatility) to identify low-value SKUs. Streamline inventory through bundling, discontinuation, or VMI. Share your findings across teams and challenge every SKU to justify its place on the shelf.

3. Supplier performance accountability

EOFY data often reveals missed delivery windows, order discrepancies, or excessive lead time variability that gets overlooked month-to-month.

Now’s the time to put supplier performance under the microscope.

Best Practice:

Track year-to-date delivery in full, on time (DIFOT) per supplier. Flag underperformers and use that data to drive service level improvements or tier suppliers by reliability.

4. Process optimisation and continuous improvement

EOFY exposes cumulative inefficiencies: repeated stock write-offs, growing manual workarounds, rising fulfilment labour costs.

What was once a “temporary fix” often becomes permanent and expensive.

Best Practice:

Use EOFY data to launch targeted improvement projects. Start with process mapping workshops focused on high-friction tasks like returns, cross-docking, or cycle counts. Set CI targets tied to measurable outcomes, not abstract KPIs.

5. Cross-functional alignment around shared priorities

EOFY insights shouldn’t stay locked in operations or finance.

The most successful businesses bring sales, marketing, procurement and operations to the same table, using EOFY data to drive unified planning.

Best Practice:

Create a shared EOFY dashboard showing key inventory, fulfilment, and margin metrics. Use it to shape promotional plans, set stocking strategies, and define cross-functional improvement goals.

EOFY is your operational x-ray

EOFY isn’t just a wrap-up. It’s a rare chance to step back, reflect, and realign.

Your data is telling you where you’re bleeding cash, where effort outweighs value, and where the biggest wins are hiding in plain sight. The businesses that take action now, not next quarter, are the ones that set the pace for the year ahead.

Whether it’s improving demand forecasting, cleaning up dead stock, or holding suppliers to account, the insights are already in your system. You just need the right tools to uncover them and the right team to act on them.

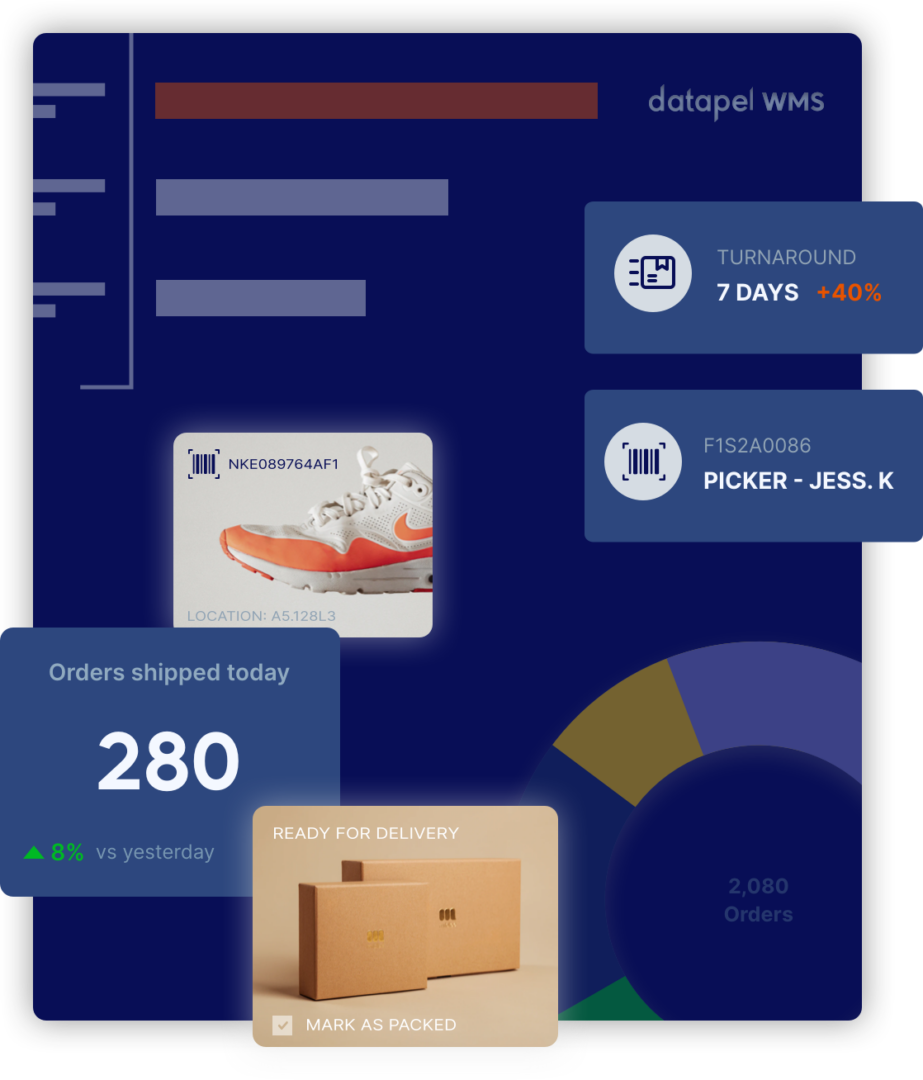

How Datapel helps

If you’re ready to stop reacting and start anticipating, Datapel can help.

Our platform gives operations and finance leaders the reporting tools and real-time visibility they need to make confident, data-backed decisions — from smarter reorder points to faster fulfilment and tighter margin control.

And with a team that speaks your language, inventory, not just IT, we’re here to help you turn this year’s stocktake into next year’s advantage.

Book a quick 15 min call to discover the Datapel difference.

As a WMS Industry Analyst & Content Lead I write about warehouse management systems from real experience—helping businesses streamline operations, reduce errors, and scale smarter.

Over the past 8 years, I’ve worked closely with warehouse teams, tech developers, and business owners to break down complex supply chain problems into actionable solutions. My goal? Make WMS content useful, not just informative.

When I’m not writing, I’m digging into user feedback, testing new tools, or speaking with industry experts to stay ahead of what matters most to warehouse operators.