9 Common Invoicing Mistakes Business Owners Make and How to Avoid Them

Contents

Every single financial transaction you make is vital for your business, so it’s essential to keep track of them with invoices or bills. These legal documents are from a seller to a buyer to record any kind of sale made. They also double as an accounting tool and inventory checker.

Typically, businesses invoice their customers after a service has been performed or a product has been shipped or delivered. The invoice document should include product or service descriptions, quantity, and pricing information.

Having these records available allows you to accurately monitor all your transactions efficiently while providing proof of payment in case of a dispute or if you need to calculate taxes or audit your inventory.

Mistakes in invoicing can cause delays in payments, errors in bookkeeping and inventory control, or even lost income if not caught in time. In this article, we’ll take a look at seven common invoicing mistakes that business owners often make and how to avoid them.

1. Waiting to invoice your customer.

Cash flow is the primary reason that 82% of businesses fail—and one of the main causes of cash flow problems is delayed invoicing.

The longer you wait to invoice your client or customer, the longer it will take to get paid and the more likely you are to forget altogether. You might feel that it’s better to invoice all your customers at once or wait until the end of the month, but the reality is that you should send invoices immediately after the completion of your service or product delivery.

To avoid this issue, it’s important to establish clear invoicing expectations with your client upfront. There are a few different ways that companies typically invoice their customers:

- Single or Recurring Invoices: Single invoices are sent only once, while recurring invoices are sent to the customer at regular interval (such as monthly or quarterly).

- Advance Payments: This requires customers to pay for products or services before they’re received.

- Progress Payments: Progress payments take place when large projects are completed in phases and require partial payment for each step.

- Down Payment: A down payment is when a customer pays a certain amount upfront before the project begins.

- Time to Payment Terms: This is the amount of time a customer has to pay off their invoice.

If you set clear expectations for how you plan to invoice your customers ahead of time, it will make it easier for you to maintain a smooth and efficient invoicing system. You’ll also create a better customer experience, as they’ll know exactly what to expect when it comes time to pay.

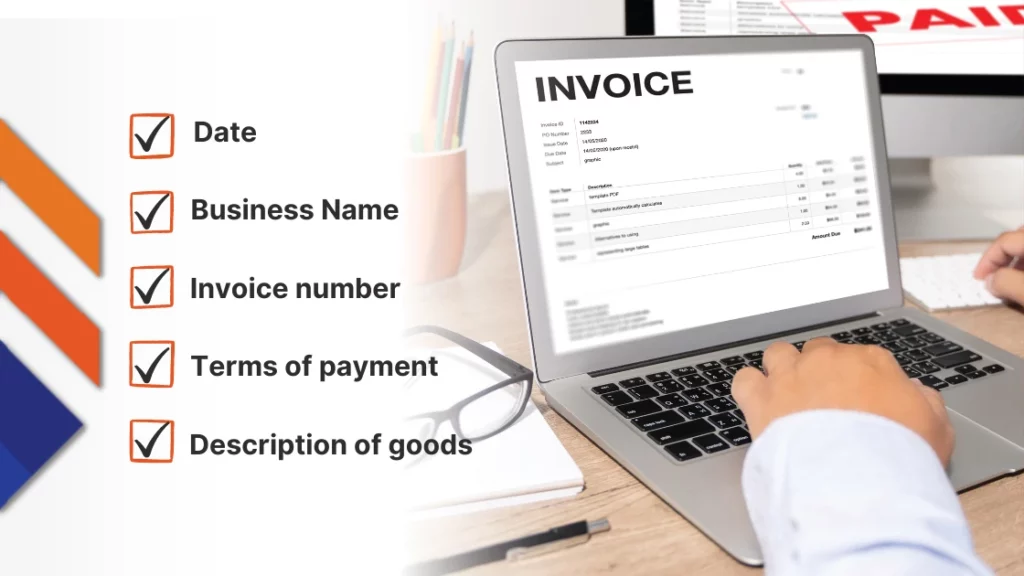

2. Leaving out relevant information in the invoice.

When creating an invoice, make sure that it includes all necessary information. But failure to do so often leads to incorrect billing and delayed payments.

The following details should be included in every invoice:

- Your name, logo, address, phone number, website, and email

- The customer’s name and contact information

- A unique invoice number (for tracking purposes)

- A detailed description of the product or service

- The quantity and cost of the product or service

- The date you sent the invoice

- The due date and terms for payment

- Any applicable taxes and discounts

It’s essential to note that failure to itemise your invoices is another form of omission—even if you think your client knows exactly what they are paying for, it’s important to list all the services or products you provided and include a detailed breakdown of pricing (even if they are all the same price).

3. Failing to account for taxes.

Tax laws for product and service businesses vary from region to region and country to country. They will also vary depending on the services you provide or the products you sell. It’s important to understand the applicable tax rates in your area and include them on all invoices.

In some cases, failing to do so can result in penalties, fines, and even legal action if not addressed immediately. In most cases, though, it will just lead to additional costs for your business.

To properly account for taxes on your invoices, make sure you:

- Understand the relevant tax codes in your area

- Include the applicable taxes on each invoice

- Properly compute both federal and local taxes where necessary

4. Neglecting a contract.

Contracts are fairly common, especially for established businesses and professionals who have extensive relationships with their customers.

But new business owners, freelancers, and independent contractors often forget to put one in place. In many cases, they’re so eager to make a sale or land a new deal that they neglect to draft a contract.

Having a contract helps prevent any disputes between you and the customer, as it outlines all of the relevant details including payment terms, services provided, and other important information. It’s also beneficial for tax purposes and can help protect both parties if there are any issues down the road.

The good news is that you don’t have to write a contract yourself. There are plenty of free templates available online. If sending new contracts out is a frequent task for you, there are also paid tools that businesses can use to create and send them in minutes.

When drawing up a contract, make sure it includes:

- Details about the product or service

- Payment terms and deadlines

- Refund and return policies, if applicable

- Legal liabilities (if any)

- Any other relevant information to the particular situation.

Asking your new customer to sign a contract before doing business together is neither awkward nor a dealbreaker. By setting clear expectations up front, you’ll be better prepared to invoice customers accurately.

5. Not using an automated system for sending and tracking invoicing.

McKinsey research tells us that over 30% of sales-related activities can be automated. For order management tasks like invoicing, credit checking, and payment processing, that number is closer to 50%

Tracking invoices manually is a cumbersome process, and it’s easy to miss things when there are dozens of invoices in your system at any given time. It also leaves room for human error, which could result in incorrect billing or delayed payments.

Most invoicing software solutions include numerous features that streamline the entire process, from creating invoices to tracking payment status.

- Automated invoice reminders when a send-out is due

- Electronic signatures for secure document storage

- Easy-to-use dashboards for tracking payment statuses, overdue invoices and more.

- Automated payment reminders for customers who are late on payments

- White labeling features to customise invoices with your brand’s identity

- System integration with business banking and accounting software

Most importantly, there are plenty of invoicing tools that are free and others that scale with businesses as they grow. Most accounting tools also have some form of invoice management software integrated into their system.

6. Not keeping a consistent format for invoices.

Creating and sending out an invoice is essentially a form of communication with your customer. As such, it’s important to make sure that each invoice you send looks professional and contains all the necessary information in an easy-to-understand manner. Otherwise, how could you expect your clients to take you seriously (and pay you on-time)?

There are plenty of invoice templates available online and most digital invoicing tools come with a list of pre-designed formats to choose from. Once you decide on a template, make sure you stick to it each and every time.

You’d be surprised. Brand consistency—even in your invoices—helps customers keep you top-of-mind. And it can benefit you in PR, talent sourcing, and other seemingly unrelated areas.

7. Unclear payment terms.

In your customer interactions (and denoted somewhere in your contract), you should always clearly define your payment terms. It’s important to explain the payment method (e.g., cash, check, etc.), how much and when customers are expected to pay their invoices.

How you word things matters, too. Businesses traditionally use the term “net” to convey the number of days a customer has to pay. For example, “Net 30” means that customers have 30 days to make payment after receiving their invoice.

But Freshbooks found that using clearer language that is more generally understood and accepted—like “Payment due within 30 days”—will help business owners get paid faster.

For example, using the phrase “Please pay within 30 days of receipt” and adding a time stamp to your invoices will help customers understand when payment is due.

8. Not following up.

It can feel annoying to pester someone for a payment, but it’s essential that you follow up on your invoices. Otherwise, customers may forget they owe you anything at all!

Try to be friendly and personable when sending out payment reminders. Most accounting software has the ability to automate this process, so it isn’t as much of an inconvenience.

If you want to limit the amount of manual follow-up you need to do, consider levying a late charge on customers who don’t pay on time. This encourages customers to think twice before missing a payment deadline and helps you maintain a solid working relationship with them.

And remember to thank customers for their timely payments. A simple “thank you” goes a long way in keeping clients happy and loyal.

9. Including hidden charges.

In terms of customer relations, transparency is paramount. In many cases, it’s the difference between a satisfied customer and an angry one.

As a general rule of thumb, if you haven’t cleared up any hidden charges with your customer, you should not include them in the invoice. Not only is it just plain wrong, but it’s also bad for business because it erodes trust between you and your client.

For example:

- If you needed to outsource for a project, make sure you inform the customer about any additional costs associated with it.

- If there is a change in the scope of work or other variables, these should be made clear before continuing.

- If there are additional taxes, fees, or other charges that you may need to collect, let your customer know as soon as you learn of them.

Really, it’s all about the conversation. Make sure you communicate regularly with your customers and be upfront about any extra costs that may need to be included in the invoice.

Final Thoughts

Invoicing mistakes can cost businesses more than just money—they can damage relationships and threaten future business opportunities. Even if they happen on accident (many do), businesses need to take steps to mitigate the impact.

By following best practices and avoiding common mistakes, businesses can ensure that their invoicing process helps them keep customers happy while still getting paid on time.

Datapel enables businesses to integrate with their existing accounting systems to streamline order processing and payment. Empower your business and book a call with our experts to find out how you can streamline your order processing.

In my role, I oversee the development of insightful blogs that delve into the intricacies of warehouse management. Each piece reflects my dedication to empowering businesses through informative content. Through my team’s extensive experience in the industry, we aim to bring clarity to the complexities of WMS, helping businesses make informed decisions.

Join me on a journey through the ever-evolving landscape of warehouse technology as we explore the latest trends, industry insights, and practical tips to streamline your operations. Feel free to connect, and let’s embark on a collaborative exploration of how WMS can redefine your business efficiency.

Cheers to innovation, efficiency, and the exciting world of warehouse management!