Buffer Stock: Strategies for Optimal Inventory Management

Contents

Buffer stock is key to market stability and supply.

This article gets to the nitty gritty of how to maintain buffer stock for economic and inventory balance, for those managing or studying supply chain complexity.

Takeaways

- Buffer stock schemes are government programs to stabilise commodity prices, and ensure the supply of essentials and economic stability by buying excess and releasing when prices go up.

- Ideal buffer stock levels are calculated through complex formulas that consider demand variations, lead times and sales history to ensure supply chain continuity and avoid overstocking or stockouts.

- Despite the strategic benefits of buffer stock in price stability and protecting economies from market volatility, they come with financial, administrative and management headaches that can lead to inefficiency and stagnation.

What is Buffer Stock Schemes

In the world of economics and supply chain management, buffer stock schemes are a demonstration of forward thinking.

These are government programs, carefully crafted to smooth out market volatility. By acting as a buyer or seller, the government wants to protect economies from sudden price changes and supply shocks.

These schemes go beyond price control; they are about:

- ensuring the supply of essentials when scarcity is looming

- stabilising commodity prices

- stabilising domestic industries

- protecting livelihoods and national economies.

How Price Stability Works

Price stability, the basis of buffer stock schemes, is all about buying excess when prices are low and releasing back into the market when prices go up.

This supply and demand dance absorbs the shock of price movements, protects farmers’ incomes and prevents their businesses from collapsing during downturns. By doing so, these schemes aim to stabilise prices.

The impact of this stability is wide-ranging, reducing the risk of food shortages and shielding farmers and consumers from economic volatility.

It’s a system where the government is the key player, using these stocks as a tool to balance the market and keep prices within a range that’s good for all parties involved.

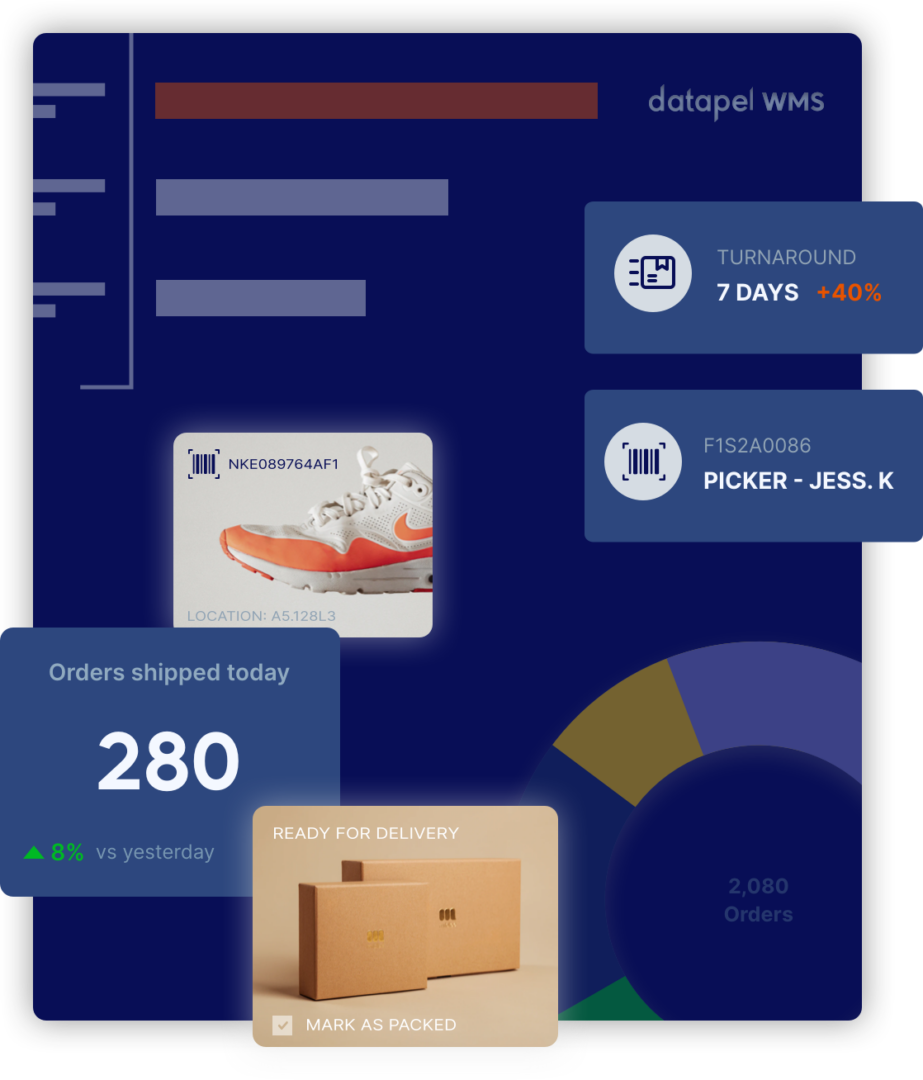

Supply Chain Management

Buffer stock is like a life jacket in the rough seas of global trade, giving businesses a flotation device to stay afloat during disruptions.

Whether it’s a delay in raw material delivery, a sudden factory shutdown or a sudden surge in customer demand, buffer stocks are there to fill the gap.

They are the behind-the-scenes heroes that strengthen supply chains, so companies can continue to operate smoothly when obstacles arise that could otherwise cause downtime and lost sales.

It’s all about balance.

- Using historical data to forecast future needs without overstocking

- Being agile to adjust to short-term market changes

- Not having costs go out of control when stock levels hit certain thresholds

How to Calculate Buffer Stock Level

Finding the right buffer stock level is like finding the sweet spot in a complex equation. Several variables to consider — demand fluctuations, lead time uncertainty and sales history.

There’s no one answer here; it’s a combination of strategies — fixed levels to complex formulas that take into account maximum and average daily usage, average lead time and maximum lead time.

The more complex the calculation, involving statistical models and demand fluctuation understanding, the smoother the flow of goods and the supply chain keeps running.

Buffer Stock in Real Life

Buffer stocks are not just theoretical, they are real tools used by governments around the world to protect against the whims of nature and the market. So the dinner table stays upright and food grains and essential commodities are available even during a bad harvest or economic turmoil.

These stocks are a piece in the risk management chess game, a safety net that allows countries to absorb supply chain disruptions, so agricultural products and other essential goods keep flowing.

For countries whose economy is tied to commodity exports, buffer stocks are a shield, stabilising export revenue and fortifying the economy against the ups and downs of international trade.

International Cocoa Organisation (ICCO) and the Real World

The story of the International Cocoa Organisation (ICCO) is an example of buffer stocks in action. From 1980 to 1993, ICCO managed a buffer stock scheme for cocoa that was the very definition of market regulation — buying up excess at floor prices and injecting it into the market at ceiling prices as needed.

The result? A less volatile market and cocoa farmers, especially in Côte d’Ivoire, had more stable and predictable income.

It was a time of international cooperation to smooth out price volatility, a lifeline to producers who relied heavily on cocoa for their livelihood.

The Economics of Buffer Stock

Buffer stocks are a buffer against market fluctuations but they come at a cost. The money required to build up these reserves is substantial and managing the funds — through higher taxes or reallocation of government budget — is tricky.

These schemes have administration costs and require constant attention and resources to keep the stocks in check.

There’s a profit potential — buy low, sell high — but that’s not guaranteed, so governments have to live with the financial risks of these economic stabilisers.

Buffer Stock vs Safety Stock

The terms ‘buffer stock’ and ‘safety stock’ are often used interchangeably but they serve different purposes in the inventory management world. Buffer stocks are for price stabilisation for the end consumer, so sudden demand spikes don’t cause price surges.

Safety stock is the extra inventory businesses hold to protect themselves from upstream supply chain disruptions — the unexpected delays and disruptions that can mess up production schedules.

While buffer stock is for preparing for a promotional demand surge, safety stock is the plan B when a key supplier doesn’t deliver on time.

Benefits of Having Buffer Stock

Having buffer stock is a smart move, it has many advantages across the economy. They promote price stability and encourage investments in agriculture which means development and wealth in rural areas.

These reserves are a safety net against shortages, so businesses can keep production and employment going even during unexpected market volatility.

Buying more inventory when supply is abundant can result in cost savings from bulk discounts from suppliers. This gives companies — especially online stores — a heads-up on their stock levels and market operations.

Challenges and Costs of Buffer Stocks

While buffer stocks have many strategic benefits, they are not without challenges and costs. Some of the challenges and costs of buffer stocks are:

- Holding costs are high, require more space and tie up capital that can be used more productively.

- Managing these schemes is a logistical nightmare itself, with huge administrative costs that weigh heavily on government agencies.

- The guarantee of a market for produce can lead to oversupply, farmers may overuse chemicals to maximise yields.

Governments also have to contend with:

- setting the right prices and quantities to buy, a process full of uncertainty and inefficiency

- buffer stock schemes can stifle agricultural innovation and efficiency, as subsidies can reduce the incentive to cut costs and be responsive to market signals

- the balancing act between supporting producers with minimum prices and giving consumers access to affordable food, a tough one to navigate.

Some products, especially perishables, have their challenges, they are not suitable for long-term storage so buffer stock policies don’t apply.

Buffer Stock History

Buffer stock is an old strategy with deep roots, it’s necessary to balance food supplies.

This is shown by the Han Dynasty’s ever-normal granary system in China where they buy surplus during abundant periods to regulate grain prices and ensure food availability.

The Genesis Wheat Stores from biblical times also prove this age-old concept of stockpiling. By storing wheat for 7 years of plenty, future shortages were prevented.

These old methods prove that buffer stocks are still relevant today as a defence against agriculture’s ups and downs and market volatility.

Conclusion

We have seen the many faces of buffer stock schemes and how they stabilise prices, supply chain and economies. The right calibration of buffer stocks allows governments to hedge against market uncertainty, a safety net for industries and consumers.

But the journey is not without risks, managing these stocks is costly and complex. Despite the challenges, the benefits often outweigh the costs, and it’s a foundation for good planning.

Let this buffer stock piece be a reminder of their quiet but important role in the balance of supply and demand that makes our world go round.

Frequently Asked Questions

What is an example of a buffer inventory?

An example of a buffer inventory is when a jam and jelly manufacturer and wholesaler keeps extra levels of raw materials like fruits and sugar in stock to account for supply disruptions from their supplier, called safety stock.

What are the advantages of buffer stock?

Buffer stock maintains market price, minimises food shortages, and prevents sudden price drops and shortages which benefits both suppliers and consumers.

What is buffer stock GCSE?

The buffer stock scheme as taught in GCSE is setting up a reserve of commodities to stabilise market volatility and balance supply and price.

This intervention is to manage the stockpile to stabilise costs in the market, so availability and price is consistent.

What is a buffer stock scheme?

The government implements a buffer stock scheme to balance commodity prices and secure supply by buying and selling stocks in the market to maintain predetermined prices.

How do buffer stocks stabilise prices?

By buying surplus commodities when prices are low and selling during high prices, buffer stocks maintain price balance. This helps stabilise farmers’ income and prevent food shortages.

This approach consequently facilitates a steadier marketplace that benefits both producers and consumers alike.

In my role, I oversee the development of insightful blogs that delve into the intricacies of warehouse management. Each piece reflects my dedication to empowering businesses through informative content. Through my team’s extensive experience in the industry, we aim to bring clarity to the complexities of WMS, helping businesses make informed decisions.

Join me on a journey through the ever-evolving landscape of warehouse technology as we explore the latest trends, industry insights, and practical tips to streamline your operations. Feel free to connect, and let’s embark on a collaborative exploration of how WMS can redefine your business efficiency.

Cheers to innovation, efficiency, and the exciting world of warehouse management!